What is cuckoo smurfing?

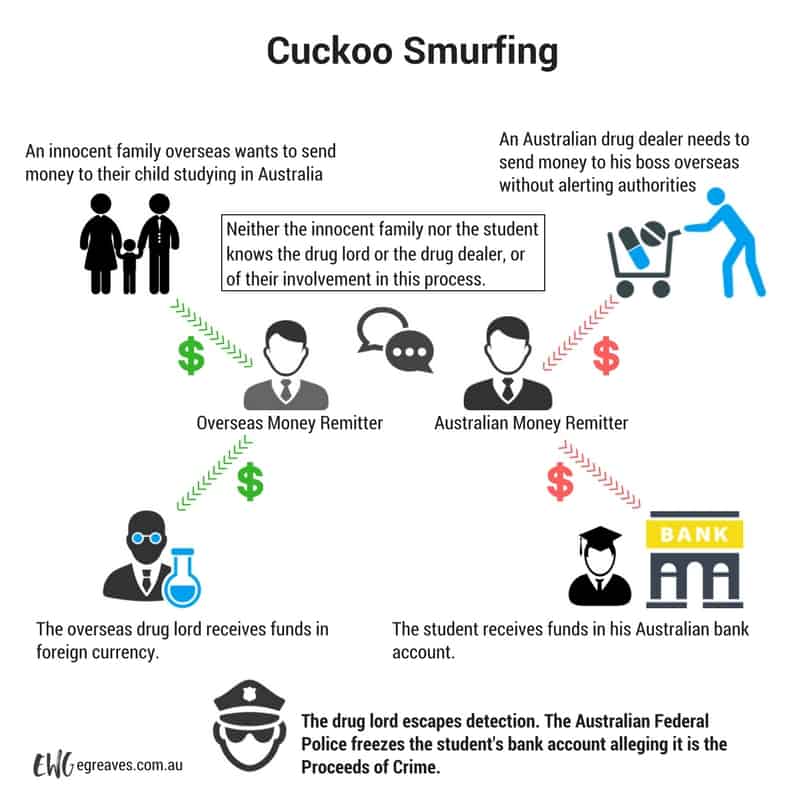

Cuckoo smurfing is a type of money laundering. It is relatively simple for criminals to use. It can be used to move vast sums of illicit cash from regulated first world countries (where drug prices are high) to both safe havens (where the drug dealers can enjoy the high life) and to countries where drugs are sourced (so that advance payment for the next batch to be delivered to Australia can be made).

Cuckoo smurfing syndicates are dedicated syndicates of organised criminals who help other criminals (usually but not necessarily exclusively drug dealers) to move illicit cash.

What does cuckoo smurfing depend upon?

Cuckoo smurfing makes illegal use of a perfectly legal and common way of moving money: alternative remittance. Alternative remittance has been around for thousands of years, it certainly pre-dates Western banking by centuries. It involves professional remitters who ‘swap’ the money of respective clients, thus allowing their clients to move the value of their money over vast distances without actually carrying anything of value across such distances. In bygone days of bandits and warlords, it was of obvious advantage not to carry gold bullion and such on horseback over hundreds or even thousands of miles.

In parts of the Middle East and Asia in particular, alternative remittance is still very popular.

Alternative remittance is lawful in Australia. It is highly regulated (as is western banking) by the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AMLCTF Act).

Alternative remittance (in a grossly simplified way) works like this (using an example from times past): A and B are people who want to move money in opposite directions, say from one side of China to the other side. Person A wants to send a gift to his parents. Person B needs to pay a supplier for goods he has purchased. They each need to send the same amount, but in the opposite direction. A and B do not know each other. A and B could each send a man on horseback with gold coins. That is expensive and risky. Enter the services of X and Y who are alternative remitters in the respective cities. They know and trust each other. They are part of an extensive network of remitters. So:

- A makes payment to X,

- B makes payment to Y,

- X then makes payment (using the money given to him by A) to B’s supplier of goods, and

- Y makes payment (using the money given to him by B) to A’s parents.

Of course X and Y each charge a relatively modest fee for this service.

How does cuckoo smurfing work?

Cuckoo smurfing does not require the use of a licenced alternative remitter in Australia. It does require the use (indeed the corrupt agreement of) a remitter offshore.

The following steps explain how cuckoo smurfing works:

- The Australian drug dealers have a vast sum of cash from the sale of methamphetamine, cocaine etc on the streets of Perth, Sydney, Melbourne etc. They need to keep the cash safe – there are other criminals who would be happy to steal it from them. Equally if they stockpile it and the Police find it, the cash itself will be highly incriminating. Of course they also want to be able to use the cash to buy more drugs and to enjoy the profits. In short they want to get it out of reach of Australian Police and get it where they can use and enjoy it.

- A corrupt alternative remitter in a country with lower levels of financial regulation (Indonesia, Malaysia, India, and even Singapore are popular) has innocent legitimate clients who want to send money to Australia (perhaps Australian ex pats, or more often people who reside in that country and want to invest in Australia or send money to their children who may be studying in Australia). These clients know that Western banks charge substantially higher exchange rates and that they can often get a better rate (perhaps 1-2% better by using alternative remittance).

- The innocent person offshore (I will use the example of the parent sending money to a child studying in Australia) pays the foreign equivalent of AU$100,000 to a licenced (but corrupted) alternative remitter in that country. This could be by domestic bank transfer to the remitter or in cash. In many countries cash is not uncommon in large legitimate transactions.

- Low level agents of the cuckoo smurfing syndicate employ ‘smurfs’ to meet up with drug dealers on the streets of large Australian cities, collect $100,000 in cash (in Australian bank notes) and then deposit it into the student’s Australian bank account (the student is expecting $100,000 as the parents have said it is coming).

- The syndicate knows and the smurfs (who may be backpackers only in Australia for a short time) are told, that if they walk into an Australian bank with $100,000 in a backpack they will likely be arrested immediately (the bank will literally call the Police on the spot) on suspicion of having possession of money unlawfully obtained.

- The smurfs are also told that Australian banks must report cash deposits of more than $10,000 into any account to a central authority, AUSTRAC. This obligation arises under s 43 of the AMLCTF Act.

- The smurfs are told to deposit no more than about $9,900 cash at a time. They must go to multiple branches of the same bank across the city (usually on the same day) and make multiple deposits. To deposit $100,000 would require at least 11 deposits at 11 different branches. This is where the smurfs get their name – like the characters in the TV show they busily run around. The activities of smurfs are sometimes called ‘smurfing’. In Australia the term ‘structuring’ is often used in lieu of smurfing. Regardless of terminology, the payments are made in a way so to avoid the bank making a report of the deposits.

- The student checks the balance of their Australian bank account and sees the amount expected has arrived.

- The student in Australia will tell their parents the money has arrived. The remitter offshore will likely check with the parents and be assured it has arrived. The student may or may not notice the odd deposit pattern. If they do notice it, they may mention it to their parents. If their parents ask about it, the remitter offshore will likely say ‘that’s how it is done in Australia’ or similar’

- The remitter offshore now makes the foreign currency received from the parents available to the Australian drug syndicate, either in the foreign country or in another safe haven.

- Weeks later the Australian bank’s computer systems (which run complex algorithms over all accounts from time to time) will likely detect the unusual deposit activity. The bank will typically report the activity to AUSTRAC (under s 41 AMLCTF Act) as a ‘suspicious matter’. These reports are protected by secrecy provisions and the account holder will never know the report was made.

- AUSTRAC may forward the information on to Police.

The word ‘cuckoo’ in cuckoo smurfing comes from the cuckoo bird. It lays its eggs in the nests of other birds. These syndicates lay their illicit cash in the accounts of other innocent people.

Consequences for the Australian government

Until around 2014, the Australian government accepted that cuckoo smurfing victims were innocent victims. About that time the Australian Federal Police decided to start restraining (freezing) the Australian bank accounts that received the structured funds. The AFP would then seek to forfeit (confiscate) the money.

Legal consequences for innocent victims

Account holders have started to resist the AFP’s attempts at forfeiture under the Proceeds of Crime Act. I have acted for a number of these account holders.

High Court decision

In late 2019 the High Court handed down its Proceeds of Crime decision in Lordianto v AFP; Kalimuthu v AFP. I was counsel for Kalimuthu. I have written several blog posts about this series of litigation. The High Court’s decision is explained here.

if you believe you have been the victim of cuckoo smurfing, please contact me to discuss how I may assist you.

More information

In January 2010 the Australian published an interesting article, Billions laundered through innocent parties.